Bridging loan how much can i borrow

Heres what that means. A bridging loan is high-cost finance compared to other types of borrowing such as a mortgage.

Bridging Loan Dbs Singapore

The amount you will be able to borrow depends on.

. The rest will be borrowed through a mortgage. Ad Purchase Refi Cash out Commercial Residential Investment Foreclosure. In cash terms bridging loan providers might lend anything between 25000 and over 25m.

If approved get help supporting your business goals. This figure is known as your peak debt. This is particularly useful if youve purchased a property that is.

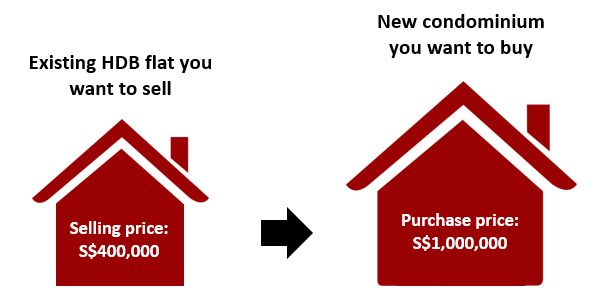

In some cases very experienced developers are able to borrow 100 of their development costs as a bridging loan. Ad Apply and if approved Use Business Funding Today Tomorrow Anytime. Heres how a typical bridging loan might work.

If your gross monthly income is 5000 the maximum amount of debt you can service is 3000. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. At the current interest rate a.

To be eligible the lender. Perhaps the most common purpose is to allow you to buy a new home or business premises before you have sold your existing. Get a Business Loan Today.

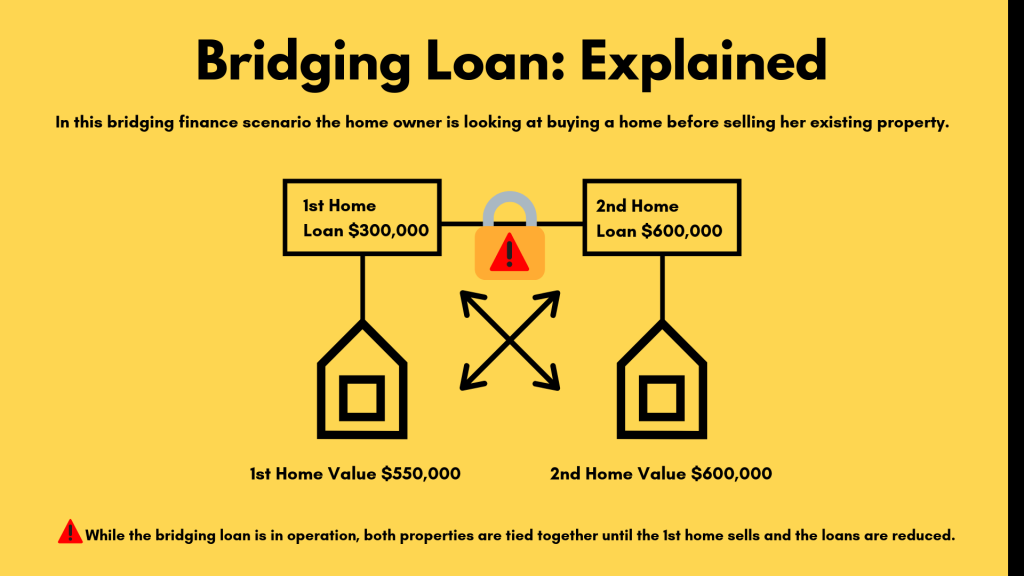

You can secure bridging loans on commercial residential or mixed-use property in Ireland or the United Kingdom. A Bridging Loan covers the time between buying a new property and settling on the sale of your existing one. Estimate how much you can borrow for your home loan using our borrowing power calculator.

But youll usually only be able to borrow a maximum loan-to-value ratio LTV of 75 of the value of. If you own the property outright and you have no loans secured against it. Calculation of MSR is based on loan amount and combined.

Arrangement fees also known as product fees or facility fee are charged by almost all lenders. Skip the Bank Save. Ad Has the value of your home gone up.

Get Instantly Matched with the Best Personal Loan Option for You. Youre eyeing up a new house priced at 350000 You need 100000 to put down as a deposit. A bridging loan can allow you to borrow up to 100 of the purchase price of your new property plus the associated costs.

Bridging loans are used to cover all. How much can I borrow with a bridging loan. Find A Lender That Offers Great Service.

Ad Apply and if approved Use Business Funding Today Tomorrow Anytime. Click Now Apply Online. Apply Now With Quicken Loans.

Bridging Loan Interest Rates Standard LTV-based residential bridging loan interest rates are as follows. Whilst the LTV loan-to-value ratio will determine how much you can borrow up to our usual lending. Bridging loans are calculated on the amount owing on your current mortgage plus the purchase price of your new property.

Our lenders offer loans from 50000 to 15 million. Now is the time to cash out. View your borrowing capacity and estimated home loan repayments.

Bridging loans are a way to borrow money against the equity you have in a property. A bridging loan is a short-term loan used to cover the financing gap between selling your old home and purchasing your new property. Lock Your Mortgage Rate Today.

If approved get help supporting your business goals. The interest rate is 26 and you and the amount can either be up to 90 of the propertys price or depending on the assessment whichever is lower. Up to 50 LTV starting from 043 per month 50-65 LTV starting.

Compare Mortgage Options Calculate Payments. The amount youre eligible for will depend on the value of the assets you already. 2 Years in Business 200k Annual Revenue Recommended for Largest Selection.

Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. Mortgage calculator Calculate how much mortgage youll be able to borrow to buy a home based on your income. Generally around 1-3 of the amount borrowed is charged as an.

Ad Were Americas Largest Mortgage Lender. Ad Compare 2022s Top Online Lenders. The FHA loan cash out refinance is more available now than ever before.

Therefore your total monthly payments for all debts. CommBank bridging loans have a maximum loan term of 12 months. Bridging loans can be used for a wide variety of purposes.

1 day agoThis week the average interest rate on a 10-year HELOC is 616 downa bit from 617 the previous week and 620 the high over the past year. Ad Compare More Than Just Rates. In some cases a high LTV mortgage combined with a short tie-in period may be more suitable.

What Is Property Bridging Loan How Does It Work In The Uk

Calculator Bridging Loan Ifg Home Loans

Bridging Loans Commercial Bridge Finance For Business

Don T Miss 6 Ways To Use Bridging Loans Loantube

100 Bridging Loan Who Qualifies And How Does It Work Youtube

Bridge Loans Guide Is A Bridge Loan Right For You

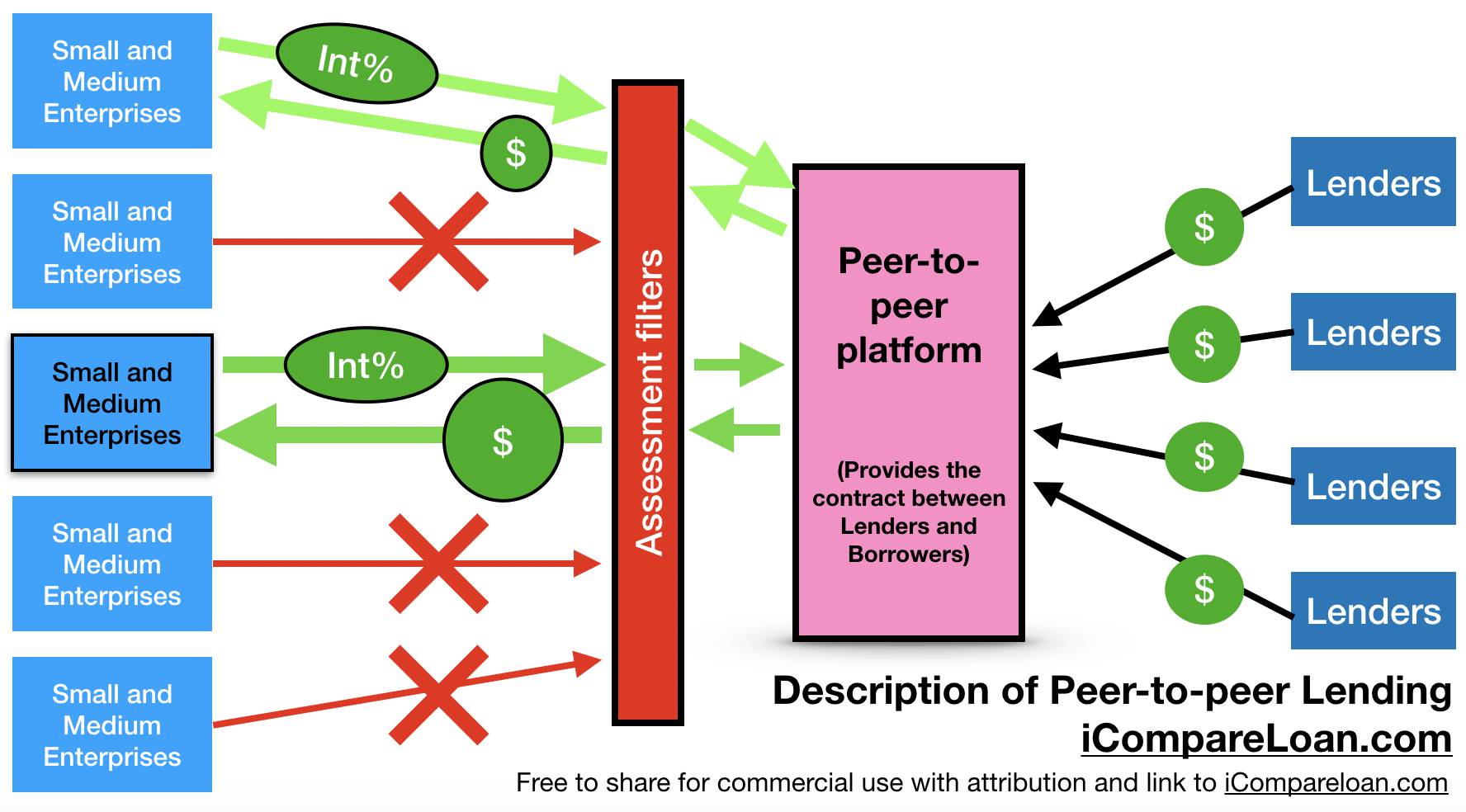

P2p Loan Vs Bridging Loan Things To Know And Differences

What Is A Bridging Loan Money Co Uk

Bridging Loans How Bridging Loans Work Mortgage Choice

What Is A Bridging Loan Nerdwallet Uk

Go To Guide For Bridging Loans In Singapore Singsaver

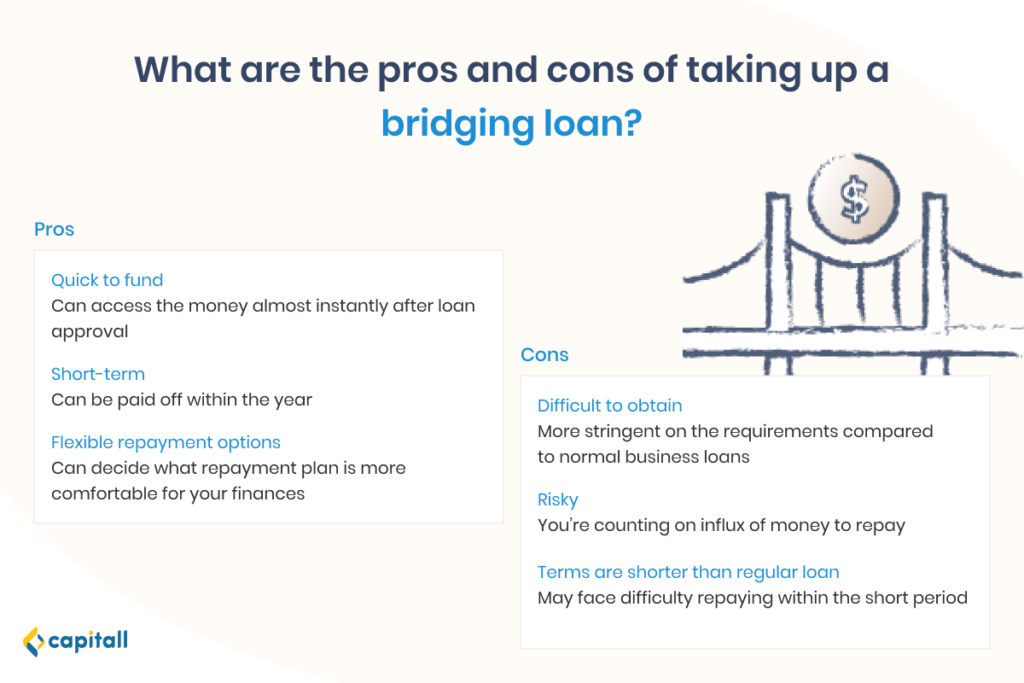

Pros And Cons Of Getting A Bridging Loan For Your Business Capitall

Bridging Loan How Does Bridging Finance Work Bridging Calculator

Ultimate Guide To Hmo Bridging Finance 2020 Hmohub

Bridging Loans Guide

Bridging Loans How Bridging Loans Work Mortgage Choice

Buy First And Sell Later With An Affordable Bridging Loan